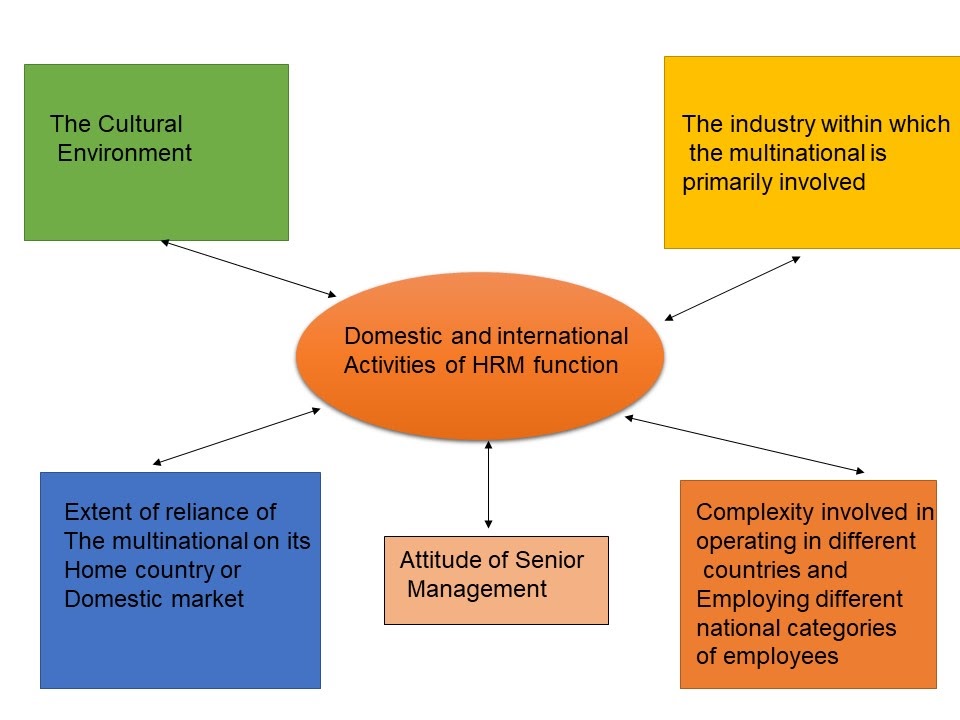

There are two major factors therefore which differentiate domestic HRM from IHRM. First, the complexities of operating in different countries (and therefore in different cultures) and secondly, employing different national categories of workers. This suggests that international HRM is concerned with identifying and understanding how MNCs manage their geographically dispersed workforces in order to leverage their HR resources for both local and global competitive advantage.

Globalization has brought new challenges and increased complexity such as the challenge of managing newer forms of network organization. In recognition of such developments, new requirements of IHRM is to play a key role in achieving a balance between the need for control and coordination of foreign subsidiaries, and the need to adapt to local environments.

International HRM differs from domestic HRM in a number of ways. One difference is that IHRM has to manage the complexities of operating in, and employing people from, different countries and cultures. A major reason for the failure of an international venture is the lack of understanding of the differences between managing employees in the domestic environment and in a foreign one. A management style successful in the domestic environment often fails if applied to a foreign environment without the appropriate modifications.]

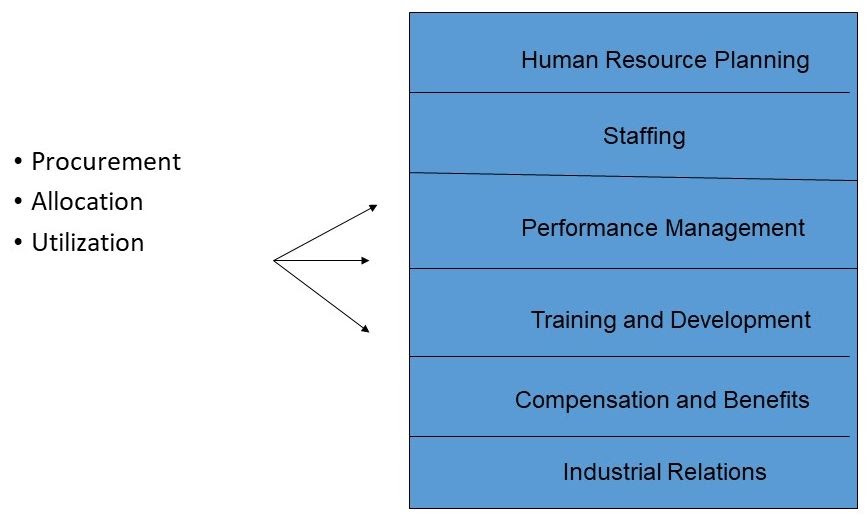

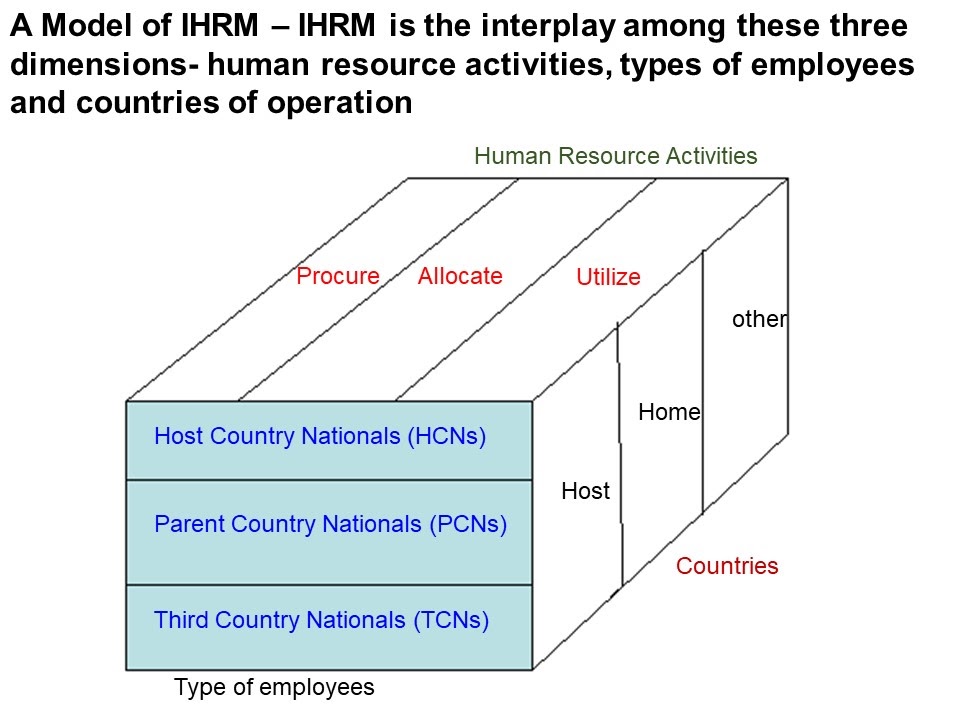

There are some commonalities in IHRM and domestic HRM practices, particularly in areas like; HR planning and staffing, recruitment and selection, appraisal and development, rewards, etc the main distinctions, however, lies in the fact that while domestic HRM is involved with employees within only one national boundary, IHRM deals with three national or country categories, i.e.,

the parent country where the firm is actually originated and headquartered;

the host country where the subsidiary is located;

and other countries from where the organization may source the labour, finance or research and development. This is because there are three types of employees in an international organization, i.e.

Parent country nationals (PCNs);

A parent-country national is a person working in a country other than their country of origin. Such a person is also referred to as an expatriate. Long periods of assignment (perhaps 4 –5 years or more) may run the risk of “de facto” employee status in the host country, so that labor laws or the host country apply.

A U.S. parent-country national residing abroad still owes U.S. taxes each year on his or her worldwide income. The US has income tax treaties with over 35 other countries. The IRS and the foreign taxing authorities can exchange information on their citizens living in the other country. Qualifying U.S. citizens and residents working outside the United States are permitted to elect to exclude a portion of their foreign earned income under the Internal Revenue Code (IRC). This section provides a general exclusion limited to a specified amount, another exclusion measured by foreign housing costs, and, for self-employed persons, a foreign housing cost deduction.

To qualify for the foreign earned income and housing cost exclusions, the individual must have foreign earned income, his or her tax home must be in a foreign country, and he or she must meet either of two tests:

The bona fide residence test, which requires the taxpayer to be a bona fide resident of a foreign country or countries for an uninterrupted period that includes a full tax year, or The physical presence test, which requires the individual to be present in a foreign country or countries at least 330 full days during a period of 12 consecutive months. A U.S. citizen may qualify under either the bona fide residence or physical presence test. A U.S. resident alien working abroad can qualify under the physical presence test, and in certain limited cases, tax treaty nondiscrimination rules may permit qualification under the bona fide residence rule.

Host country nationals (HCNs); and

They are those employees of an organization who are the citizens of the country in which the foreign subsidiary is located.

Third country nationals (TCNs).

Third Country National (TCN) describes and individuals of other nationalities hired by a government or government sanctioned contractor who represent neither the contracting government nor the host country or area of operations. This is most often those performing on government contracts in the role of a private military contractor.

Third Country Nationals

These are the citizens of a country other than the country where the organization is headquartered and the country that is hosting the subsidiary.

The reasons that IHRM is more complex than domestic HRM are described below.

- International HRM addresses a broader range of activities than domestic HRM. These include international taxation, coordinating foreign currencies and exchange rates, international relocation, international orientation for the employee posted abroad, etc.

- Human resource managers working in an international environment face the problem of addressing HR issues of employees belonging to more than one nationality. Hence, these HR managers need to set up different HRM systems for different locations. Human resource managers in a domestic environment administer HR programmes to employees belonging to a single nationality.

- International HRM requires greater involvement in the personal life of employees. The HR manager of an MNC must ensure that an executive posted to a foreign country understands all aspects of the compensation package provided in the foreign assignment, such as cost of living, taxes, etc. The HR manager needs to assess the readiness of the employee’s family to relocate, support the family in adjusting to a foreign culture through cross-cultural training, and to help in admitting the children in schools. The HR department may also need to take responsibility for children left behind in boarding schools in the home country by the employees on foreign postings. In the domestic environment, the involvement of the HR manager or department with an employee’s family is limited to providing family insurance programmes or providing transport facilities in case of a domestic transfer.

- There is heightened exposure to risks in international assignments. These risks include the health and safety of the employee and family. A major aspect of risk relevant to IHRM today is possible terrorism. Several MNCs must now consider this factor when deciding on international assignments for their employees. Moreover, human and financial consequences of mistakes in IHRM are much more severe than in domestic business. For example, if an executive posted abroad returns prematurely, it results in high direct costs as well as indirect costs.

- International HRM has to deal with more external factors than domestic HRM. For example, government regulations about staffing practices in foreign locations, local codes of conduct, influence of local religious groups, etc. If an American organization is sanctioned license by the Indian government to set up its subsidiary in India, the American company is under legal obligations to provide employment to local residents.

- International HRM Addresses a broad range of HRM activities. Whereas domestic HRM deals with issues related to employees belonging to single nationality.

- Greater exposure to risks in international assignments; human and financial consequences of mistakes in IHRM are very severe.

Common activities between Domestic HRM and IHRM